Announcing the Marin Loan Fund, Round 2!

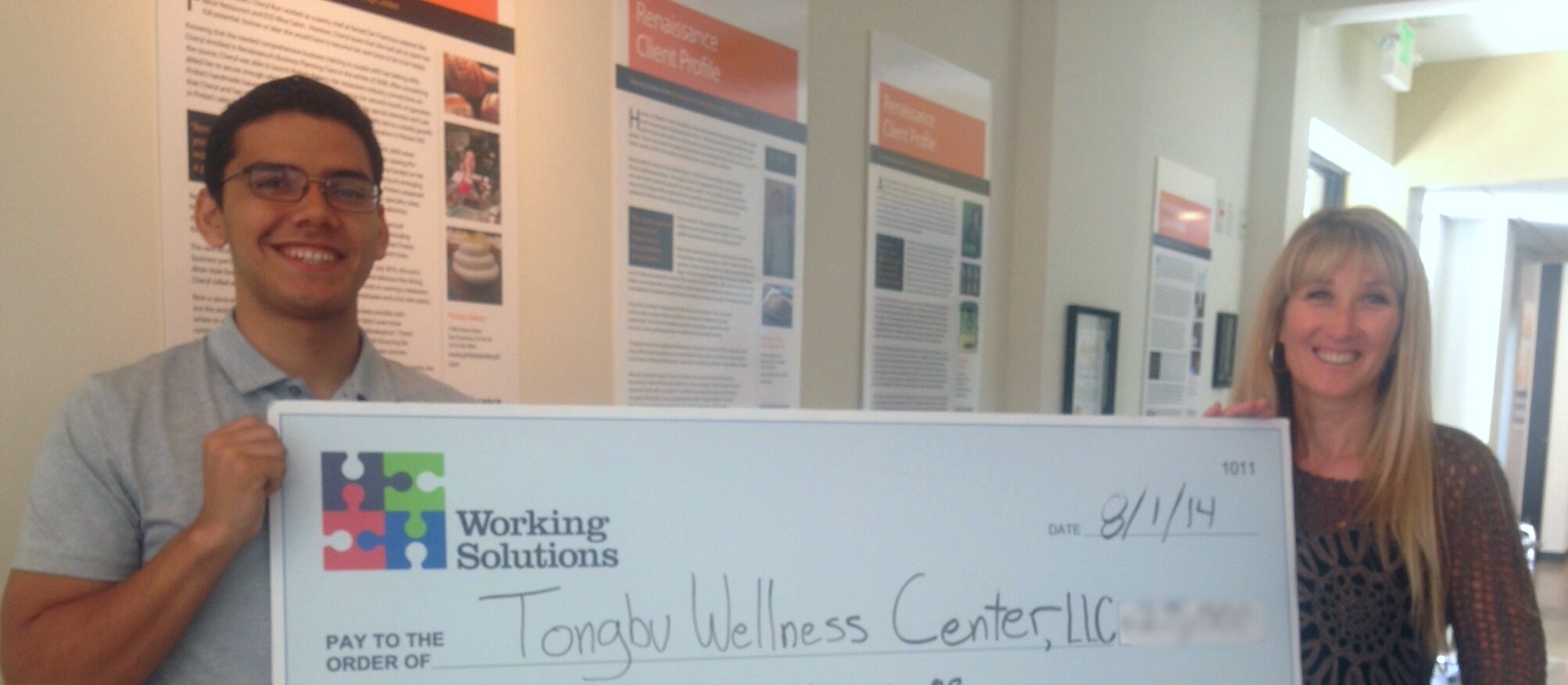

Working Solutions Business Lending Associate Roberto Hernandez with Tongbu Wellness Center Owner Heide Nielsen

Working Solutions, a Bay Area nonprofit microlender, today announces the second round of funding for its Marin Loan Fund for small businesses. The fund, initially launched in June 2014 with an investment of $200,000, will be extended with an additional $190,000 thanks to the generous support of the Marin financial community.

The Marin Loan Fund is a collaborative partnership between the Marin Economic Forum, a nonprofit focused on improving Marin’s economic vitality and social equity, Working Solutions, and Marin financial institutions. Seven local financial institutions contributed to both rounds of the fund: Bank of Marin, First Community Bank, First Bank, Opus Bank, Presidio Bank, Redwood Credit Union, and Wells Fargo Bank.

“We were able to fund eight low-income entrepreneurs in five months of the fund’s first round,” Working Solutions CEO Emily Gasner said. “That’s a true testament to the need for affordable financing in the Marin small business community.” Gasner said 63 percent of the funded businesses are owned by women, and half are start-ups with less than two years in business. “More than a year into their loan terms, all eight businesses are thriving and have created or retained 26 jobs in the Marin community.”

According to Dr. Rob Eyler, chief economist of the Marin Economic Forum, every dollar of revenue generated by a Working Solutions borrower creates an estimated $2.16 in the local economy through local taxes, wages, and other spending.

Tongbu Wellness Center, a community alternative healthcare center in Novato, is one of the businesses funded by the Marin Loan Fund. Owner Heide Nielsen launched her business in 2014, but her start-up status made bank funding difficult to find. The Marin Economic Forum and Bank of Marin referred Heide to Working Solutions, where she received a loan from the Marin Loan Fund along with post-loan services like consulting on her marketing plan and financial mentorship from a Redwood Credit Union employee. A year later, Tongbu Wellness Center has created seven jobs in Marin.

Laurie O’Hara, Working Solutions’ Director of Business Development, hopes that the Marin Loan Fund can serve as a model for similar programs in other Bay Area counties. “What we’ve built here is a partnership between nonprofits and banks to create a program that understands the local context and is bolstering the economy in a sustainable way. We’re thrilled to have the support of our bank partners as we expand the Marin Loan Fund to double the impact of the program.”

To learn more about Working Solutions' lending and business consulting programs, please see our Loan Overview page.

Laurie O'Hara, Working Solutions Business Development Director